Incoterm CFR (Cost and Freight): your supplier pays the freight, but the risk is yours

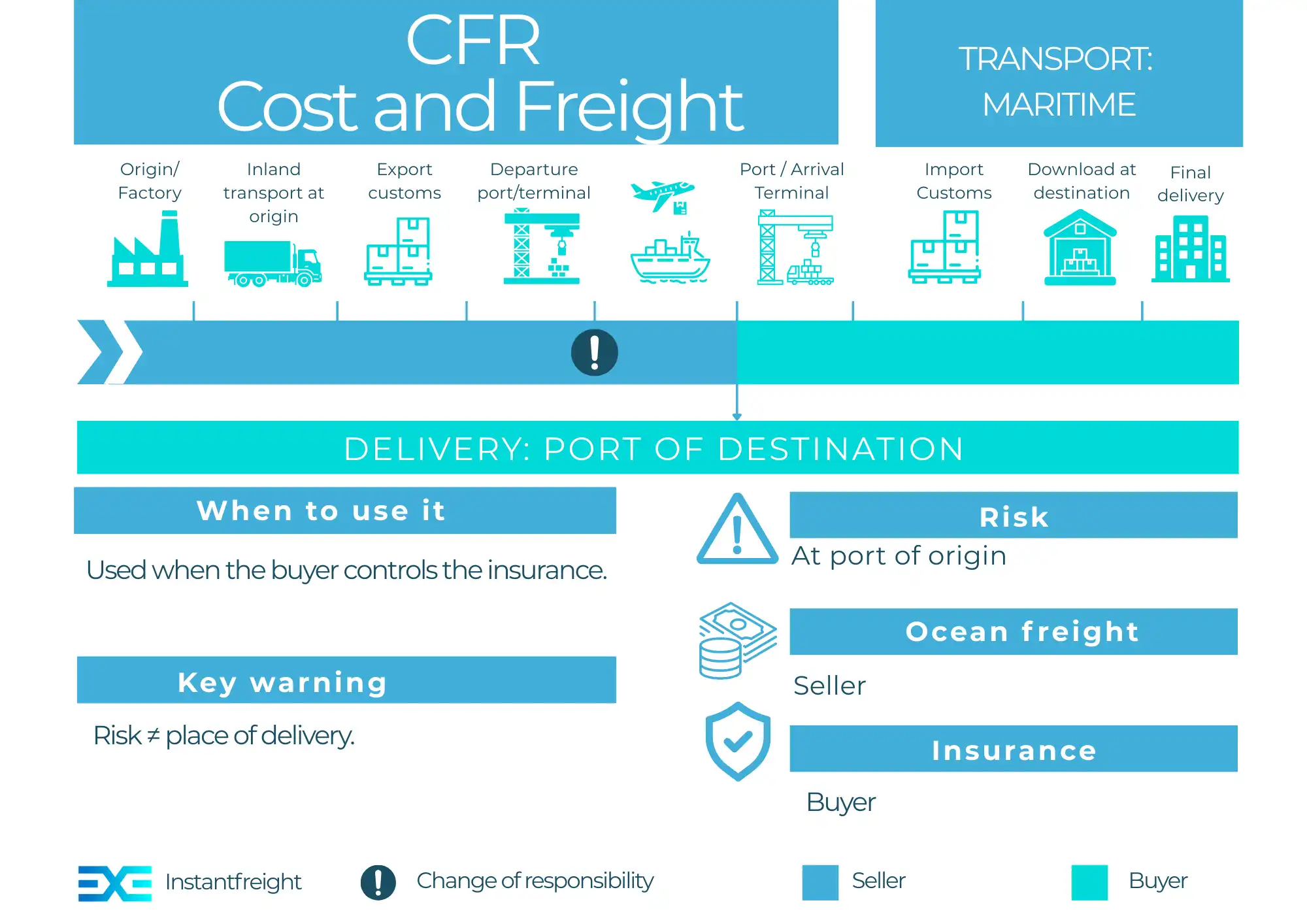

The CFR Incoterm (Cost and Freight) is a rule used exclusively for sea and inland waterway transport. Under this term, the seller pays for the main carriage (sea freight) to the agreed port of destination, but the risk for the goods transfers to the buyer at the port of origin.

It is crucial to understand this Incoterm, as responsibility for costs and risk are split at two different points in the logistics chain.

GET A RATE FOR YOUR SHIPMENT IN SECONDS

How CFR works: delivery and risk are split

With the CFR Incoterm, the seller assumes responsibility for logistics until the goods are on board the vessel. The transfer of risk occurs at the port of origin, but the seller continues to pay for the freight to the port of destination.

Practical example:

You buy a batch of solar panels from a supplier in China under Incoterm CFR (Port of Southampton).

Transport organisation at origin

Transport organisation at origin

The Chinese supplier organises and pays for the transport from their factory to the Port of Shanghai.

Loading on board the vessel

Loading on board the vessel

The supplier also handles the loading of the panels on board the vessel.

Transfer of risk

Transfer of risk

The moment the panels cross the ship's rail in Shanghai, the risk of any damage or loss passes to you, the buyer.

Cost distribution

Cost distribution

The supplier pays for the sea freight from Shanghai to Southampton.

Your responsibility

Your responsibility

If the container with the panels falls into the sea during the voyage, the cost of the loss is yours. Once the goods arrive in Southampton, you are responsible for unloading, import customs clearance, and all costs up to your warehouse.

Responsibilities under Incoterm CFR

Seller's responsibility:

- Packing and preparing the goods.

- Arranging and paying for land transport at origin.

- Arranging and paying for export customs clearance.

- Loading the goods on board the vessel.

- Arranging and paying for sea freight to the port of destination.

- Assuming risk until the goods are on board.

Your Responsibility as a buyer:

- Assuming the risk from the moment the goods are on board the vessel at the port of origin.

- Arranging and paying for goods insurance (highly recommended).

- Arranging and paying for unloading at the port of destination.

- Arranging and paying for import customs clearance, taxes, and duties.

- Paying for transport from the port of destination to your warehouse.

CFR vs. CIF: the key difference is insurance

The difference between CFR and CIF is fundamental and often the cause of misunderstandings, so it is important to know the scope of each one:

CFR

The seller is not obligated to arrange insurance. It is your responsibility as the buyer to protect the cargo.

CIF

The seller is obliged to arrange minimum insurance for the goods in your favour.

If you choose CFR, you must be aware that your cargo is travelling without insurance arranged by the seller. It is vital that you arrange insurance on your own to protect the goods you have purchased that are travelling in sea freight.

Other Incoterms

Ex Works

The least responsibility for the seller. The goods are delivered at their warehouse or factory. The buyer assumes all costs and risks from that point.

Free Carrier

The seller delivers the goods to the carrier designated by the buyer.

Carriage Paid To

The seller pays for transport to the agreed destination.

Carriage and Insurance Paid To

The seller pays for transport and insurance to the agreed destination.

Delivered at Place Unloaded

The seller assumes all costs and risks until the goods are delivered and unloaded at the agreed destination (e.g., a terminal or warehouse).

Delivered At Place

The seller delivers when the goods are made available at the agreed place.

Delivered Duty Paid

The seller assumes all costs and risks until final delivery.

Free Alongside Ship

The seller delivers the goods to the carrier designated by the buyer.

Free On Board

The seller delivers when the goods pass the ship's rail.

Cost, Insurance and Freight

The seller pays the cost, insurance and freight to the destination port.