Incoterm DDP (Delivered Duty Paid): your supplier does EVERYTHING for you

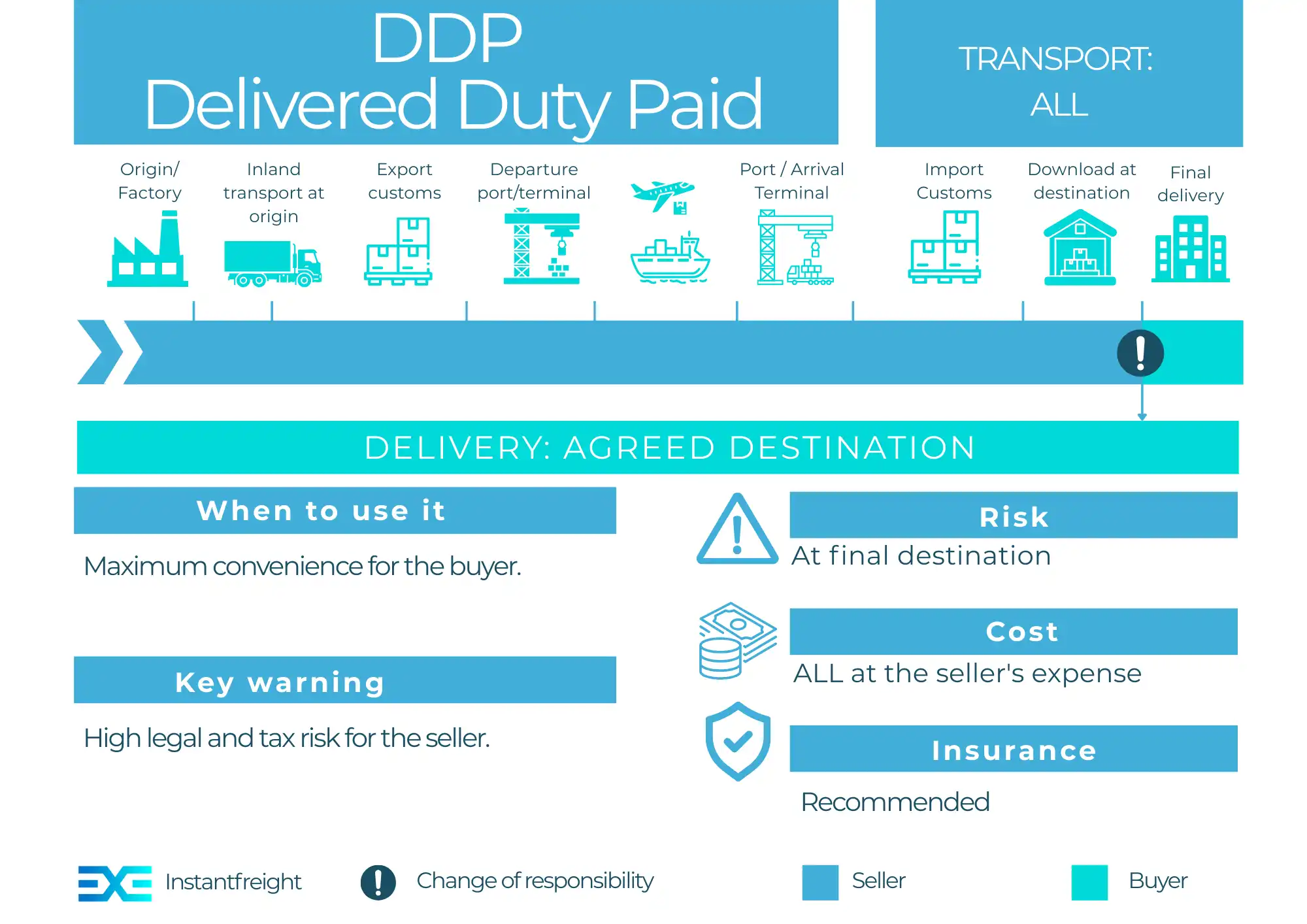

The Incoterm DDP (Delivered Duty Paid) represents the maximum responsibility for the seller and the minimum for the buyer. If you have agreed to this Incoterm, your supplier handles the entire logistics process: from transport at the origin to delivery at your warehouse, including import customs and the payment of all taxes and duties.

It is, without a doubt, the most convenient delivery term for the importer, as your only responsibility is to receive the goods.

GET A RATE FOR YOUR SHIPMENT IN SECONDS

How DDP works: the "turnkey" delivery

Under the DDP Incoterm, the seller assumes all costs and risks from their warehouse to the agreed destination. The risk transfers to the buyer the moment the goods arrive at your door, ready to be unloaded.

The Seller is responsible for:

Transport at origin

From their warehouse to the port/airport.

Export customs clearance

All procedures and costs in the country of origin.

Main carriage

Sea, air, or land transport.

Goods insurance

It is advisable, though not mandatory, for the seller to take out insurance to cover their risk.

Transport at destination

From the arrival port/airport to your address.

Import customs clearance

Crucial. The seller manages and pays all procedures, duties, taxes (such as import VAT) and customs fees in the destination country.

Final point of delivery

Making the goods available to you at the agreed location.

Your responsibility as a buyer is greatly reduced, specifically to:

Unloading the goods

Unloading the goods from the lorry at your warehouse.

Assuming the risk

Assuming the risk of the goods once they are unloaded and in your possession.

Practical example:

You purchase furniture from a supplier in China under the DDP Incoterm (your warehouse in London).

Your Chinese supplier organises all transport, from their factory in China to your warehouse in London.

Your supplier handles export customs in China and import customs in the UK, including the payment of duties and import VAT.

The lorry arrives at your door in London, and your only responsibility is to unload the goods.

At that moment, the delivery is complete, and the risk of the goods passes from your supplier to you.

When is it advisable to use DDP?

You are a buyer with no experience in importing

It is ideal if you have no knowledge of customs procedures, duties, or international transport.

You want an "all-inclusive" price

If you need to know the total cost of your product delivered to your warehouse without any surprises.

Your supplier is an expert in international logistics

It is common for large suppliers or marketplaces to offer DDP to simplify the process for the end customer.

Caution!

The cost of DDP is higher. Your supplier will include all transport, customs, and duty expenses on their invoice, so it is essential to ensure the total price compensates you for the convenience before agreeing to this type of shipping.

Additionally, as a buyer, you have limited control over the logistics process, as it is chosen by the seller, who pays for it, although it is possible to negotiate this term, it is often difficult.

Other Incoterms

Ex Works

The least responsibility for the seller. The goods are delivered at their warehouse or factory. The buyer assumes all costs and risks from that point.

Free Carrier

The seller delivers the goods to the carrier designated by the buyer.

Carriage Paid To

The seller pays for transport to the agreed destination.

Carriage and Insurance Paid To

The seller pays for transport and insurance to the agreed destination.

Delivered at Place Unloaded

The seller assumes all costs and risks until the goods are delivered and unloaded at the agreed destination (e.g., a terminal or warehouse).

Delivered At Place

The seller delivers when the goods are made available at the agreed place.

Free Alongside Ship

The seller delivers the goods to the carrier designated by the buyer.

Free On Board

The seller delivers when the goods pass the ship's rail.

Cost and Freight

The seller pays the cost and freight to the destination port.

Cost, Insurance and Freight

The seller pays the cost, insurance and freight to the destination port.