Incoterm CPT (Carriage Paid To): your supplier pays for transport, but the risk is yours

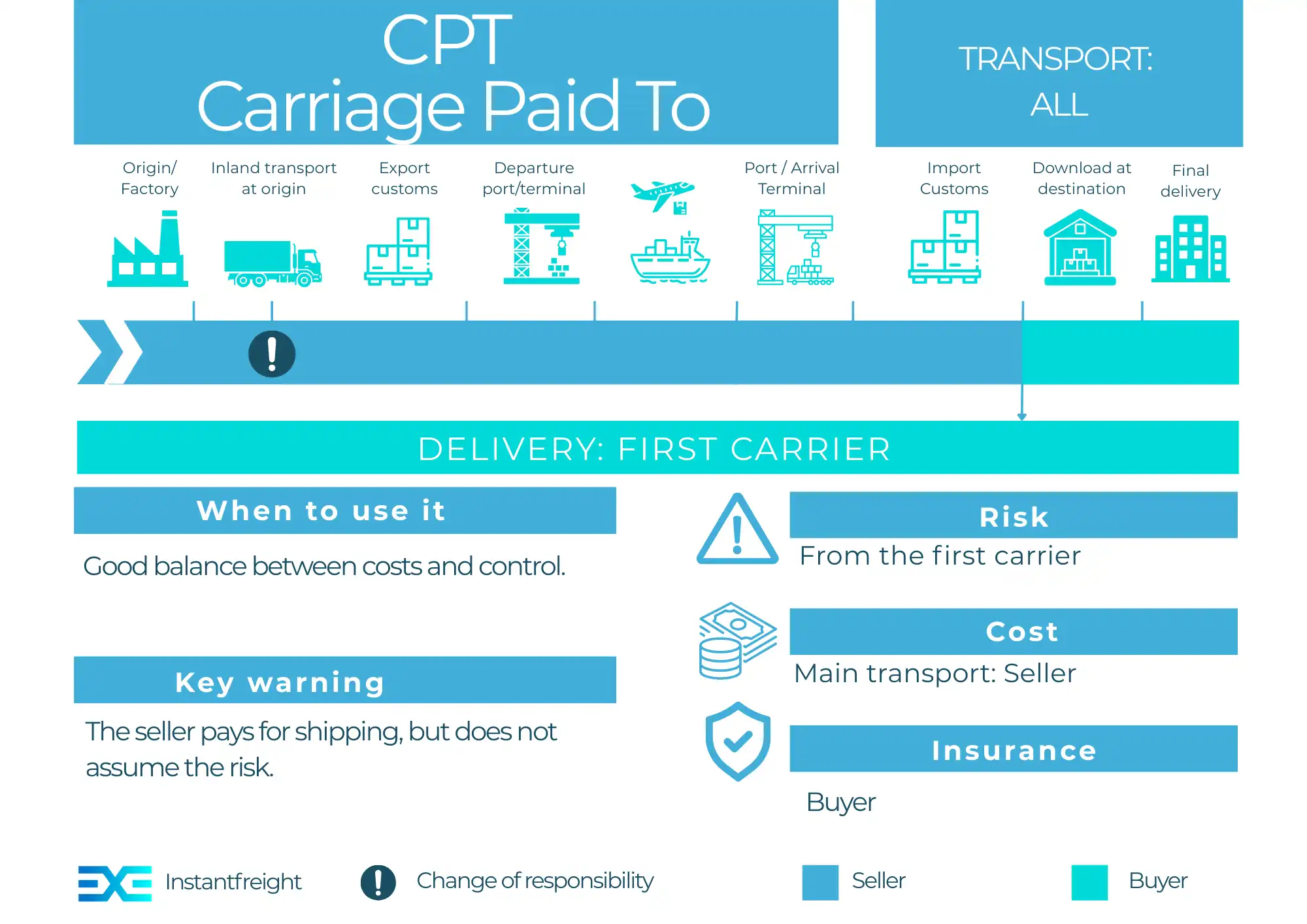

Incoterm CPT (Carriage Paid To) is a widely used multimodal rule that offers a balance of responsibilities between the seller and the buyer. Under CPT, the seller undertakes to pay for the main carriage to the agreed destination, but the risk transfers to the buyer at the point of origin.

It is an excellent option if you want your supplier to handle the initial logistics and freight costs, but you prefer to manage the insurance of your goods, ensuring the most appropriate coverage in each situation.

GET A RATE FOR YOUR SHIPMENT IN SECONDS

How does CPT work? The transfer of risk at origin

CPT is based on the concept of "double point":

Point of Delivery (Transfer of Risk)

The seller fulfils their obligation to deliver at the moment they place the goods at the disposal of the first carrier contracted. At that moment, the risk of loss or damage passes from the seller to the buyer.

Point of Destination (Distribution of Costs)

The seller pays the cost of transport to the agreed place of destination (e.g., your warehouse, a port, or an airport).

Practical Example

You buy furniture from a supplier in China under Incoterm CPT (carriage paid to Barcelona).

1Point 1 (Origin - Transfer of Risk)

The supplier loads the furniture onto the transport company's truck at their warehouse in China. The moment the truck leaves the factory, the risk of the cargo passes to you, the buyer.

2Point 2 (Destination - Distribution of Costs)

The supplier pays all costs for the goods to arrive at the port of Barcelona.

Your responsibility

If the container falls off the truck in China or there is a problem during the sea voyage, the risk is yours. You are responsible for taking out insurance for your cargo and for managing import customs clearance and final delivery to your warehouse.

Responsibilities under Incoterm CPT

Seller's responsibility

Package the goods and make them ready for transport.

Manage and pay for inland transport at origin.

Manage and pay for export customs clearance.

Contract and pay for main carriage (e.g., sea or air freight) to the agreed place of destination.

Your responsibility (buyer)

Assume the risk of the goods from the moment they are delivered to the first carrier at origin.

Contract and pay for goods insurance.

Manage and pay for import customs clearance, taxes, and duties.

Assume unloading costs at destination (unless otherwise agreed).

Contract and pay for transport from the agreed place of destination to your final warehouse.

CPT vs. FCA: What is the key difference?

It is common to ask about the difference between these two Incoterms due to their similarity. While under FCA the buyer contracts and pays for the main carriage, under CPT it is the seller who does so. Both transfer risk at origin, but CPT gives the seller more responsibility in logistics management.

CPT vs. CIP: The key lies in insurance

Another common question is the difference between CPT and CIP; CPT does not oblige the seller to take out insurance, while CIP does (with high coverage). If you choose CPT, it is essential that you take out insurance to protect your investment.

Do you need help managing your shipment under Incoterm CPT?

The correct application of Incoterms is vital to avoid surprises in your supply chain, and at Envio x Envio we know this. That is why, if you have doubts about the costs or management of your cargo, our professional team is here to help you plan your logistics efficiently and securely, clarifying any doubts so that your logistical operations are fully successful.

Other Incoterms

Ex Works

The least responsibility for the seller. The goods are delivered at their warehouse or factory. The buyer assumes all costs and risks from that point.

Free Carrier

The seller delivers the goods to the carrier designated by the buyer.

Carriage and Insurance Paid To

The seller pays for transport and insurance to the agreed destination.

Delivered at Place Unloaded

The seller assumes all costs and risks until the goods are delivered and unloaded at the agreed destination (e.g., a terminal or warehouse).

Delivered At Place

The seller delivers when the goods are made available at the agreed place.

Delivered Duty Paid

The seller assumes all costs and risks until final delivery.

Free Alongside Ship

The seller delivers the goods to the carrier designated by the buyer.

Free On Board

The seller delivers when the goods pass the ship's rail.

Cost and Freight

The seller pays the cost and freight to the destination port.

Cost, Insurance and Freight

The seller pays the cost, insurance and freight to the destination port.